3. Creating Economic Opportunity

EFG Hermes has made financial inclusion a cornerstone of its sustainable growth strategy. Over the past few years, the Group has taken firm steps to expand its NBFIs and extend its reach both to provide services to the unbanked and to create an environment of economic opportunity in the communities where it does business.

The Group currently boasts a suite of financial services that range from microfinance to leasing, factoring, e-payments, buy-now/pay-later and mortgage provision and insurance. Our strategy is driven by technology and relies on the synergies afforded by our deep industry and market knowledge to provide innovative solutions that fill a vital gap in the business ecosystems in the regions where we do business.

Supporting Small- and Microenterprise – Tanmeyah

EFG Hermes Finance acquired Tanmeyah Microenterprise Services in 2016, and it has since become one of the Group’s flagship companies under its NBFI platform. Tanmeyah, today one of the leading companies in Micro Finance Industry in Egypt, provides financing for micro and very small businesses across Egypt giving thousands of clients access to the necessary capital to find a path out of poverty and grow their businesses. The company also offers products and services that complement the diverse needs of small businesses, such as microinsurance.

Tailoring digital services to the needs of micro-entrepreneurs

In line with the country’s effort to enforce digital transformation and to accelerate financial inclusion, Tanmeyah obtained an Agency Banking license from CBE in collaboration with Banque Misr to issue co-branded prepaid Meeza Cards. In addition to its current partnership with Damen for digital collection, Tanmeyah aims to install 250 Banque Misr ATMs across its branches. Tanmeyah promotes a customer-centric environment for digital payments, offering a low-income-customer friendly method. Tanmeyah will issue the prepaid card for the client inside its branches on the same day of application. In addition, the client will have an ATM right outside the branch to facilitate ‘cash-in & cash-out’ without any extra fees. Facilitating cash-in and cash-out for the client is crucial at this stage until the country endorses a full digital ecosystem.

Tanmeyah Value Added

- A customer relationship from issuance to renewal.

- The most experienced and friendly staff in the industry.

- Wide geographic distribution particularly in underserved rural areas.

- 48-hr loan approval and disbursement procedure.

- Tiered loans let borrowers with good records access larger loans.

- Targeted support for women-owned businesses.

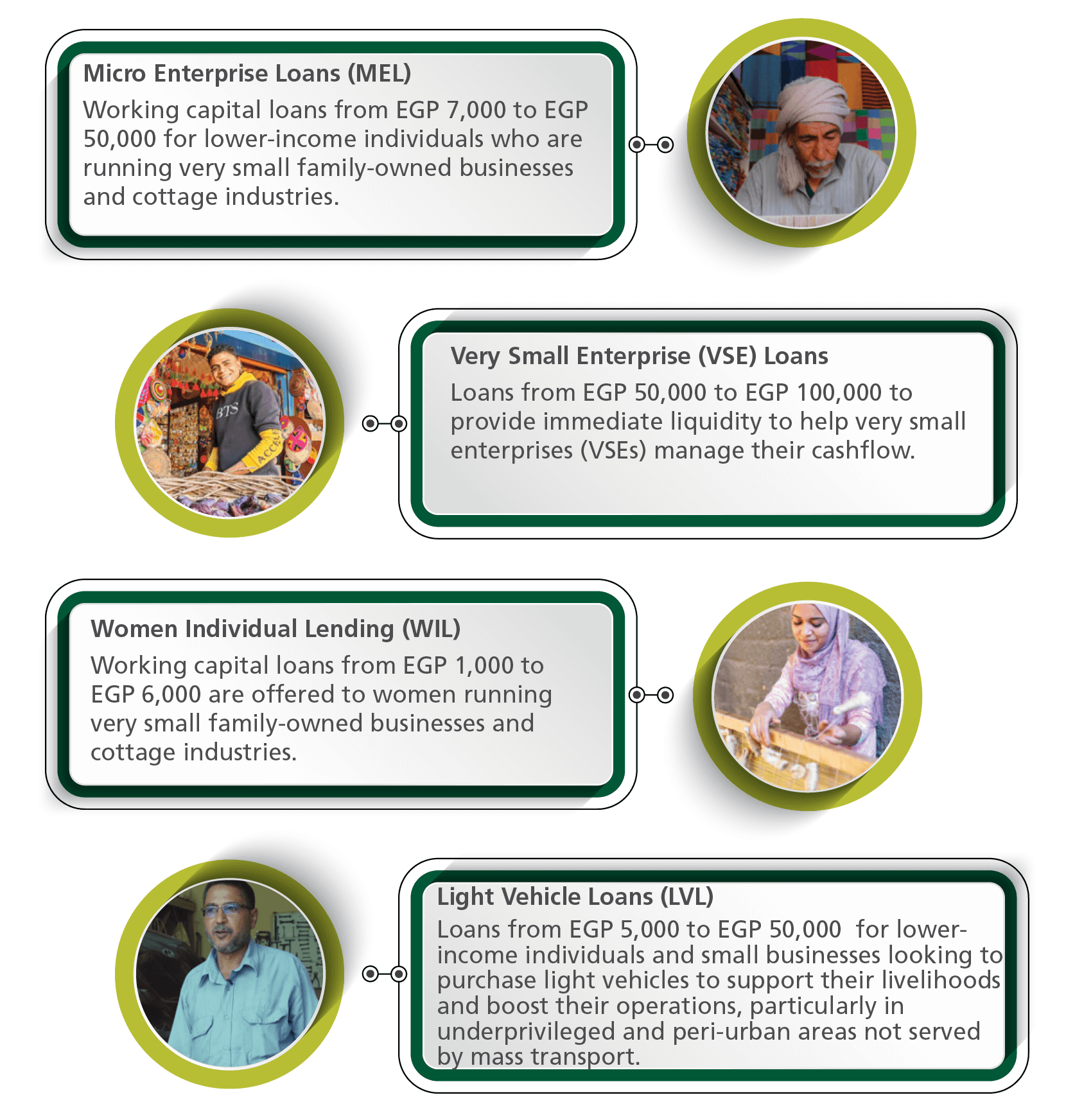

Tanmeyah Loan Services

Financing success: Stories from the Field

Sohier Mohamed, Crochet Accessory Designer

Sohier started her small project as an accessory designer six years ago. She started by providing her products to her family and friends but dreamt of expanding her small-scale project and increasing her customer base. She started displaying her products via online pages but faced financial challenges and was unable to buy the raw materials she needed.

A friend who also owns a small business referred Soheir to Tanmeyah. She was quickly granted a loan that helped her develop a wider and more diverse set of products, expand her customer base, and take her business to the next level.

Ali Mohamed Adly, Sculptor

Ali was a construction worker, but when he suffered a severe leg injury, he was forced to change his career. He learned the art of carving statues from all kinds of stones. The problem was that it required certain tools and materials that Ali was unable to afford.

After hearing about Tanmeyah, Ali headed to the nearest branch in Luxor and applied for a loan, which he received in two days. He renewed his loan with Tanmeyah several times to expand his project. In 2018, Tanmeyah gave Ali the chance to participate in a handicraft exhibition and sell his goods (pharaonic replica statues) and he was featured on television as well.

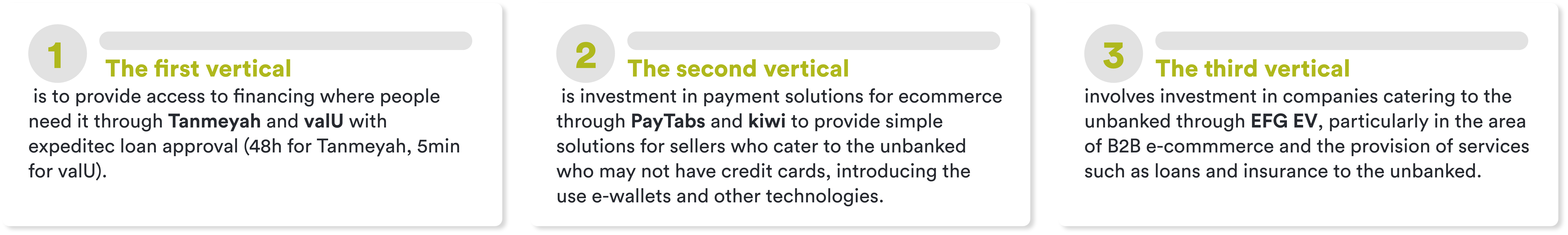

Fostering Financial Inclusion – The Synergy of our NBFI Platform

Financial inclusion and providing access both to financing and financial services are key tenets both of the SDGs and of the Egypt 2030 strategy. Through its NBFI platform, EFG Hermes has developed a number of synergistic verticals to address the unbanked and those with minimal access to financing. In addition to providing financial access to individuals, the overall objective is economic development and the creation of employment opportunities.

valU

Launched in December 2017, valU is the leading Buy Now Pay Later Solution in Egypt. valU fosters financial inclusion by providing wider access to financial services and adapting financial technology, which in turn contribute to balanced sustainable development. Today, valU’s strategy is to create value for its users and for society as a whole by further expanding its roster of offerings to include financing of vital services such as healthcare, education and renewable energy, among others, to meet the entirety of our customers’ needs, allowing them ease of financing and liquidity while pursuing their desired lifestyle.

FINANCING SUSTAINABILITY - VALU IN 2021

PAYTABS EGYPT

PayTabs Egypt is a joint venture between EFG Hermes and PayTabs that provides merchants with online or offline presence with innovative digital payment solutions.

PayTabs has been focused on offering cutting-edge technology to all types of businesses in the market that are looking to expand by accepting online payments. The company was able to execute its financial inclusion goals due to the recent initiative launched in Egypt by banks and regulators to begin providing payment tools for freelancers with just their National ID.

Focus on Youth & Microenterprise

To support freelancers further, PayTabs focuses specifically on youth and has conducted numerous outreach initiatives at employment fairs such a Shababco Bazaar, where we launched QR codes to help unregistered youth receive payments online. In line with PayTabs’ efforts to always offer soft technology alternatives rather than traditional hardware, PayTabs Egypt will also be launching PT Touch – a soft POS that will offer the regular POS capabilities on smartphones making card acceptance accessible to everyone.

Even though the ecosystem has been moving towards cashless payments due to COVID-19, the Egyptian market is still in need of improved financial literacy. In support of its commitment to empower small and medium enterprises, PayTabs has also participated in numerous educational and mentorship initiatives such as CBE Finyology, EBI, CIPE access to opportunities for MENA women, UofCanada Fintech Hackathon, MINT incubator mentorship, and Egypt Career Summit. In addition, PayTabs has opened a channel through one of our team members to support start-ups and enterprises. Furthermore, we have placed a high priority on enhancing the financial literacy of our team through regular sessions about banking, fintech, and financial inclusion.

To end the year on a high note, we rolled out a series of offers in October to encourage small and medium enterprises to move their business online.

EFG Hermes Corp-Solutions

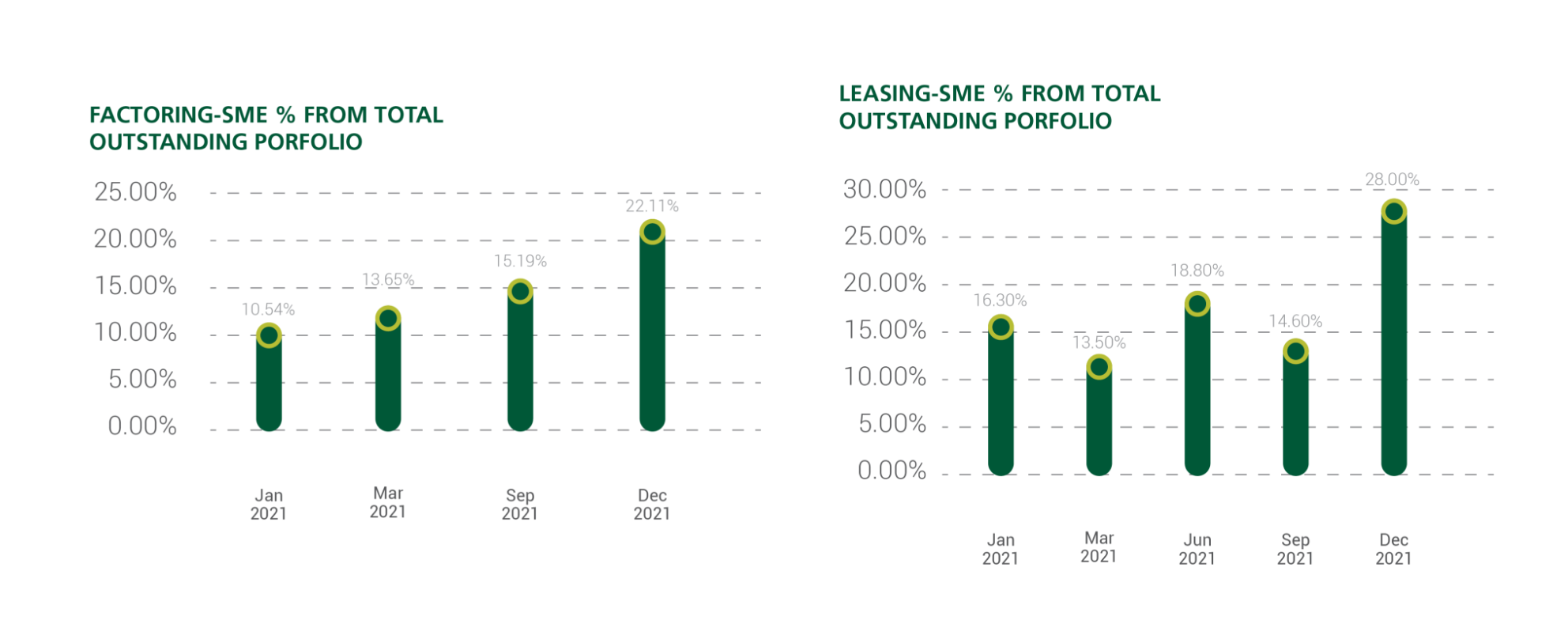

EFG Hermes Corp-Solutions has been proudly empowering SMEs in the market by facilitating lending products and programmes that fit their needs. The charts below indicate the increase in % of lending to SMEs year-on-year, bringing the total SME Factoring portfolio to EGP 421.3MM and the Leasing portfolio to EGP 1.13Bn (as of Dec 2021).

Financing Energy Efficiency

In 2021 Corp-Solutions signed an agreement with KarmSolar, Egypt’s largest private solar utility company, to provide Arkan Mall tenants with financing services backed by their contracts with KarmSolar.

The agreement will allow the mall’s tenants to access finance from Corp-Solutions leasing and factoring services and strengthens KarmSolar’s unique selling proposition by expanding the set of services it is currently offering its clients at Arkan mall. Tenants also benefit from the personalized financing options provided by EFG Hermes Corp-Solutions, offered the company’s first-of-its-kind behavioural scoring system. The system evaluates electricity consumption patterns to determine credit limits granted to each individual tenant and recommend a tailored financing programme thus improving resource use efficiency.