2. Investing with Impact

EFG Hermes is committed to investing in innovative opportunities that deliver strong financial returns while reducing poverty and inequality, advancing health and education, and protecting the environment. In addition to actively seeking out investments that address the SDGs, EFG Hermes and its subsidiaries have integrated ESG considerations into all investment decisions not only to address sustainability but also to identify and minimize risks and identify opportunities for growth that also protect our planet for future generations.

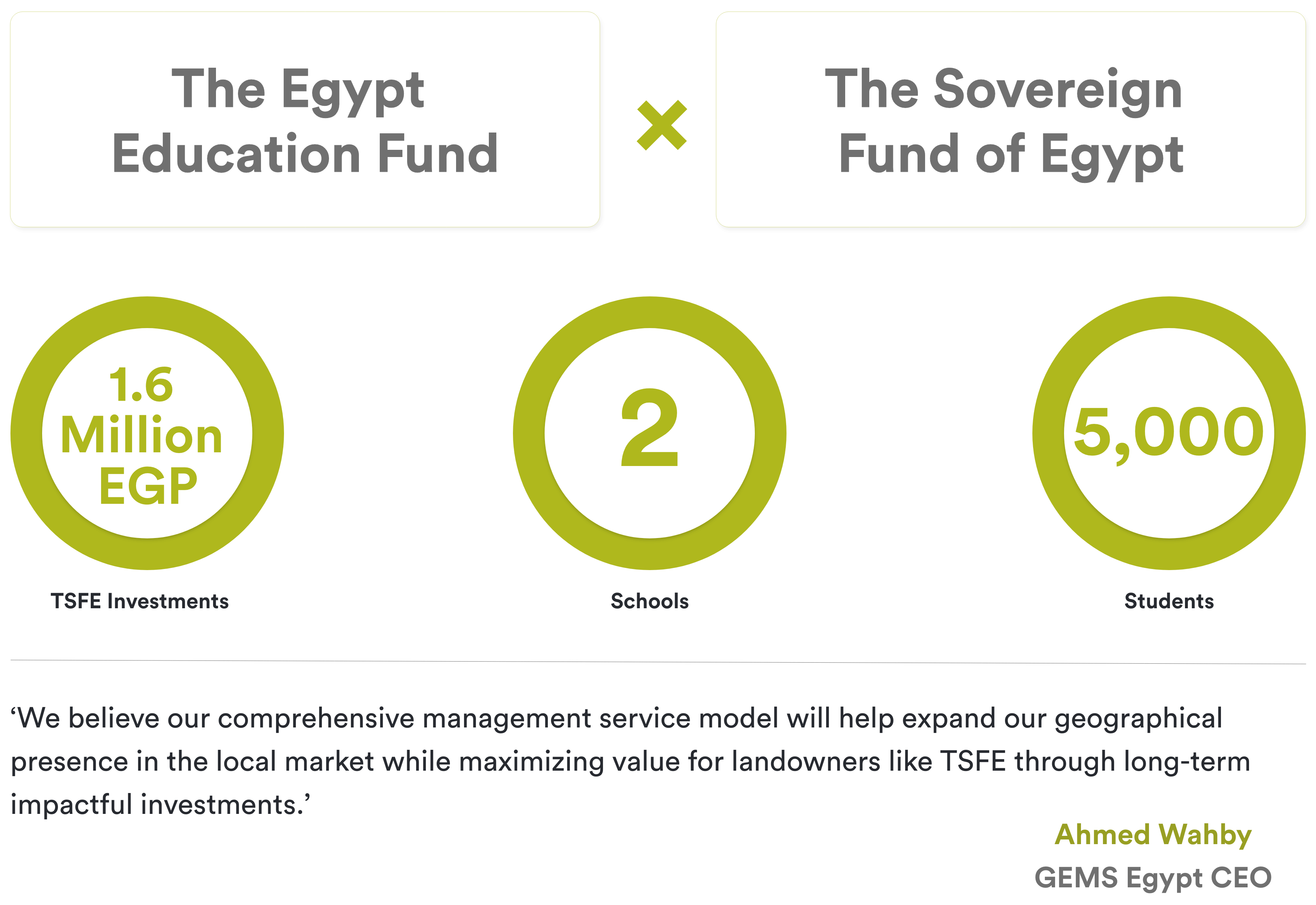

INVESTING IN YOUNG MINDS-THE EGYPT EDUCATION FUND

EFG Hermes considers education the main pillar and growth driver of the country’s economic development. As part of its commitment to impactful investment in education, in 2018, EFG Hermes Private Equity entered into an exclusive partnership with Global Education Management Systems (GEMS), one of the world’s leading providers of private English-language education for students from kindergarten to twelfth grade (K-12), to jointly establish a USD 200 million platform focused on Egypt’s underserved K-12 education sector. The partnership aims to provide high-quality education choices for Egyptian families by building Egypt’s largest institutional education service provider, upgrading education facilities and providing safe and effective learning environments. In 2019, the Fund acquired a majority stake in the leading transport provider, Option Travel to provide a high quality and competitive student transportation service to c. 6k students currently enrolled in GEMS schools in Egypt.

Our education platform continues to invest across several lines to enhance the educational journey of our students. The platform successfully launched the Model United National (MUN) simulation models across some of our schools to promote political awareness among students. The platform also successfully secured World Sports Accreditation for the first time in Egypt following significant investment made to upgrade sports facilities.

In 2021, the Sovereign Fund of Egypt (TSFE) and EFG Hermes signed a memorandum of understanding to develop and operate two premium national schools West of Cairo, which will be built over 30,000 sqm with a capacity of 2,500 students each. The schools will be constructed on TSFE-owned land in line with its mandate to create value out of previously unutilized assets. The investment is considered TSFE’s first in Egypt’s education sector and is a testament to GEMS Egypt’s success in the local market over the last two years which saw the platform deploy investments amounting to almost EGP 1.6 billion.

‘We are honoured to be partnering with TSFE and recognize the valuable addition it brings to the EFG Hermes Education Fund. Our visions and goals are in direct alignment when it comes to unlocking potential and driving value in the Egyptian education sector by developing a strong institutional presence capable of offering educational services that follow the highest global standards,’ said Co-CEO of the Investment Bank at EFG Hermes Karim Moussa. This is the third close of our education fund, which now ranks as one of the largest specialized investment funds in the MENA region. Our fund’s capital currently amounts to ca. USD 150 million, which perfectly positions us to continue expanding our scope in the Egyptian market.

REVITALIZING THE PHARMACEUTICAL SECTOR–RX HEALTHCARE MANAGEMENT

The COVID-19 pandemic has highlighted Africa ́s vulnerability due to its reliance on imports for most vaccines, medicines and other health product needs. The United Nations Economic Commission for Africa (UNECA) estimates that Africa imports about 94% of its pharmaceutical and medicinal needs from outside the continent at an annual cost of USD16bn. The need for investments in the pharmaceutical and healthcare industries is critical if SDG 3-Ensuring healthy lives and promoting wellbeing for all at all ages-is to be realised.

Always a pioneer, EFG Hermes recognised this need even before the COVID-19 pandemic exacerbated the shortfall and established Rx Healthcare Management (RxHM), a private equity investment management firm set up to address the growing demand for high-quality, affordable healthcare products and services across Egypt, the MENA region and Africa. It invests in highly selective targets, with a clear growth trajectory across healthcare verticals, giving investors access to unique opportunities across the sector’s value chain. RxHM places a high value on ESG due diligence. Target investments must combine both financial viability and fulfil ESG criteria to ensure sustainable service delivery that fills a tangible healthcare gap in this highly underserved region.

INVESTING IN RESILIENT MANUFACTURING

RxHM’s latest acquisition is leading Egyptian medical solutions provider United Pharma (UP). United Pharma is Egypt’s leading player in the injectables space by installed capacity and has an established track record of supplying the Egyptian local market as well as exports to key African and Middle East.

UP successfully closed financial year 2021 achieving its growth and market positioning targets, expanding its supply relationships across Egypt and further diversifying its distribution network, while successfully complying with the Ministry of Health’s (MOH) Good Manufacturing Practice (GMP) guidelines. During 2021, UP has allocated substantial investments to upgrading its production and manufacturing facilities to match the growing market demand in hospital essentials, while expanding its product portfolio across large and small volume products, to enhance accessibility to essential pharmaceutical products serving Egypt’s fast-growing hospital and clinical healthcare services sectors.

UP plans to capitalize on the success achieved in 2021 to expand the product portfolio by adding complementary products serving the hospital B2B segment (such

as anaesthetics, and higher value-added injectables); synergistic hydro-based products serving the B2C segment; in addition to enhancing focus on exports to neighbouring markets facing shortages in essential medical supplies.

In parallel to the ongoing value creation process within UP, Rx Healthcare platform has commenced transaction processes on a number of highly promising opportunities in the injectables and generic pharma segments, currently at different stages of negotiation & execution, and with potential aggregate deal values exceeding EGP1 billion, supporting EFG Hermes’s healthcare platform strategy of expanding its investments in the pharmaceuticals sector and accelerating the realization of SDG3.

SUSTAINABLE IMPACT THROUGH STRATEGIC INVESTMENT

EFG Hermes recognised the need for investment in healthcare in the MENA region & Africa and established RxHM to undertake strategic investment that fills a tangible healthcare gap in the region.

RxHM places a high value on ESG due diligence. Investments must combine both financial viability and fulfil ESG criteria to ensure sustainable service delivery.

RxHM’s acquisition and management takeover of United Pharma (UP), Egypt’s leading player in the injectables space, reflects this strategy.

Following a year of hands-on management under the RxHM team, UP successfully realized a full turnaround and captured a market share of 10% despite turbulent market conditions.

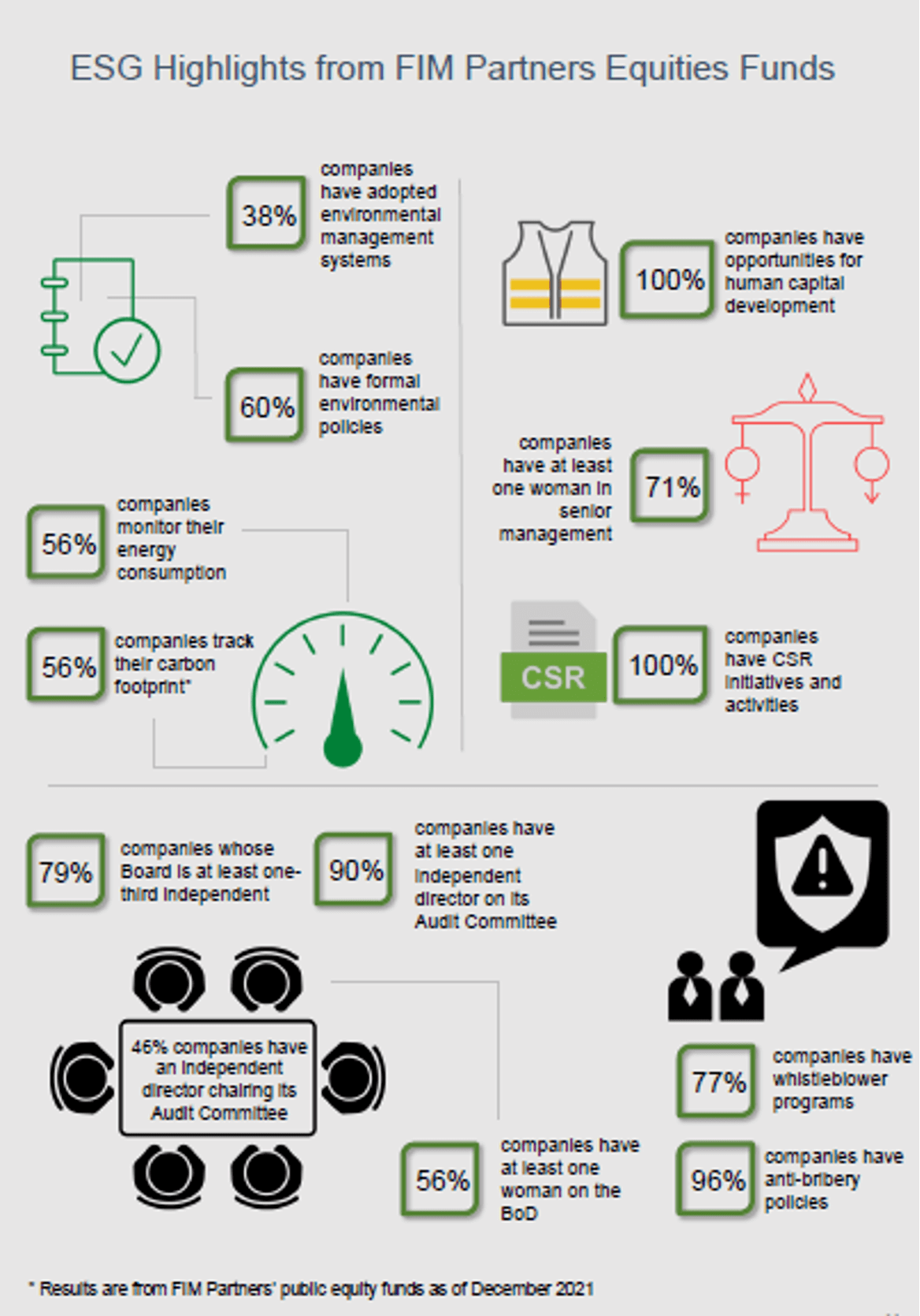

MANAGING RISK, CREATING VALUE-FIM PARTNERS

EFG Hermes’ regional asset management arm,

Frontier Investment Management (FIM) Partners,

invests in frontier and peripheral emerging

markets through global and regionally focused

strategies, delivering superior absolute, relative

and risk adjusted returns to investors since

inception. The firm’s assets under management

are invested on behalf of university endowments, sovereign wealth funds, outsourced CIO’s, and pension plans from North America, Europe, and the Middle East. Our team has built out a highly successful track record by implementing a disciplined fundamental research approach that underpins our active investment strategy in emerging and frontier markets.

We target markets that exhibit a large degree of inefficiency. This is primarily the result of capital markets being at an early stage of development. The information asymmetry imbedded in these markets allows fundamentally focused investors with strong analytical resources, active portfolio construction, and a medium to long term investment view the opportunity to generate significant and persistent outperformance over an investment cycle. The fund’s target markets also exhibit higher risk premiums than their developed counterparts (macro risks, political risks, liquidity risks, etc.) which the firm expects to be reflected in its required rate of return on investments.

The relatively high-risk profile of our investments has made integrating ESG factors of crucial importance and integral to our holistic approach. As such, the goal of achieving sustainability aligns with our own goal of generating strong risk adjusted returns with a long-term investment horizon.

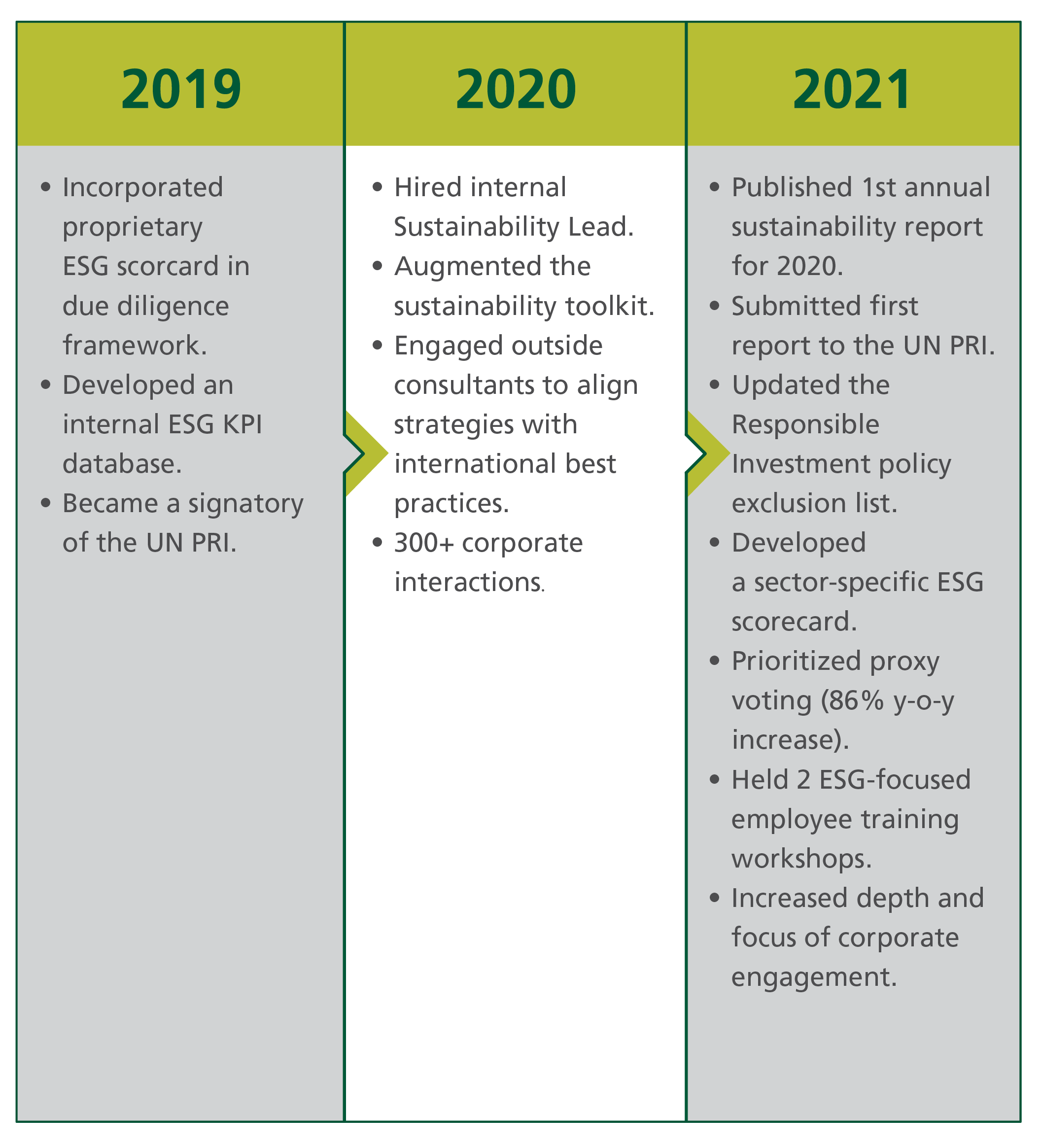

EACH YEAR, WE DEEPEN AND EXPAND OUR COMMITMENT TO SUSTAINABILITY

FIM PARTNERS IN 2021-FOCUS ON ENGAGEMENT

In addition to the importance of ESG factors in mitigating our investment risk, we feel that it is a key part of our commitment to the SDGs and the UN PRIs to engage with our stakeholders and help raise awareness. In many cases where we have engaged with portfolio companies, we have found that stakeholders are simply unaware of ESG issues rather than unwilling to implement measures and we are happy to report a high level of success in our engagement efforts. In most cases, we have seen tangible improvement in ESG indicators with only rare incidences where we have been forced to take the decision to divest.

Thanks to our sector-specific-ESG

scorecards, we generate materiality

metrics ( see chart1 ) that are in line with

global best practices. In 2021, we scored

a total of 51 listed companies across

the different public equity strategies.

The continued growth of our database provides a unique edge in an investment space which remains under-researched in terms of coverage by global ESG Risk rating providers.

These metrics allow us not only to evaluate risk, however, but form the basis of our engagement strategy with our portfolio companies by illustrating gaps and identifying areas of possible improvement.

On the issue of climate change, for example, we have developed a tiered system to identify the levels of emission for each of our investments. These tiers define the engagement road map for each investment based on their climate risk profile, with high emitters getting the highest priority. Engagement levels and time frames differ depending on the tier. Instead of only monitoring indicators, this extends our role and makes it more proactive by helping industry understand ESG needs and assisting them in developing their own monitoring, disclosure and mitigation plans.

In addition to regular engagements with our portfolio companies, we believe it is imperative to engage with local regulators and country stakeholders who can play an important role in enhancing sustainability awareness. In February 2021 FIM Partners held a meeting with the Bangladesh Security Exchange Commission to discuss key issues related to investor relations and ESG disclosures. In September 2021 FIM Partners held an engaging webinar titled ‘The Saudi Transformation from an ESG Perspective’ in order to increase awareness about the sustainability efforts that are underway in the Kingdom of Saudi Arabia.

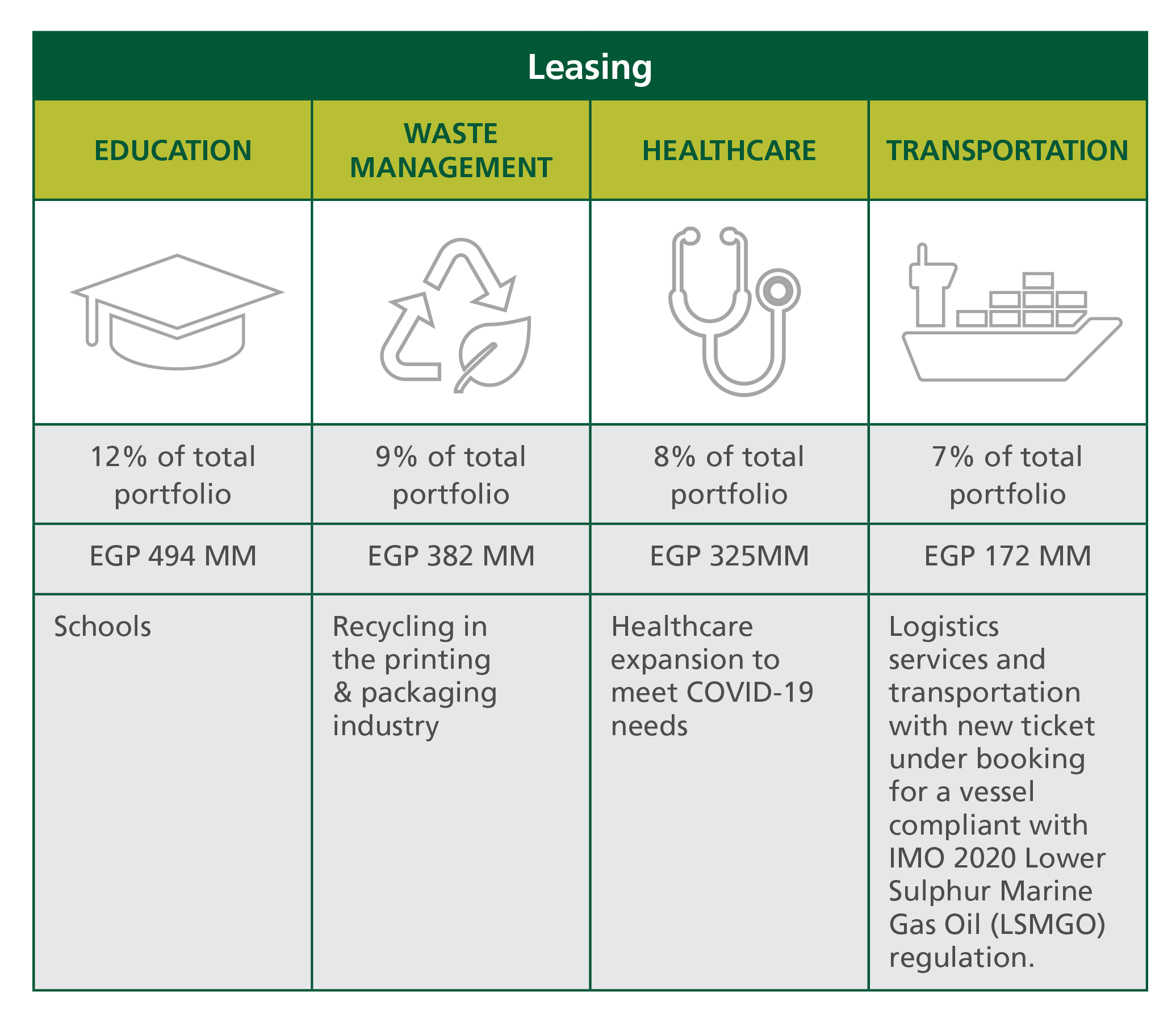

Bridging the Gap – Financing Sustainability through Corp-Solutions

The United Nations Conference on Trade and Development (UNCTAD) estimates that achieving the 17 SDGs will require USD5–7 trillion per year. The current level of investment by governments, development agencies, and other actors is not enough to meet these ambitious with the gap in developing countries at about USD2.5 trillion per year. The private sector can play an instrumental role in closing this gap. 2

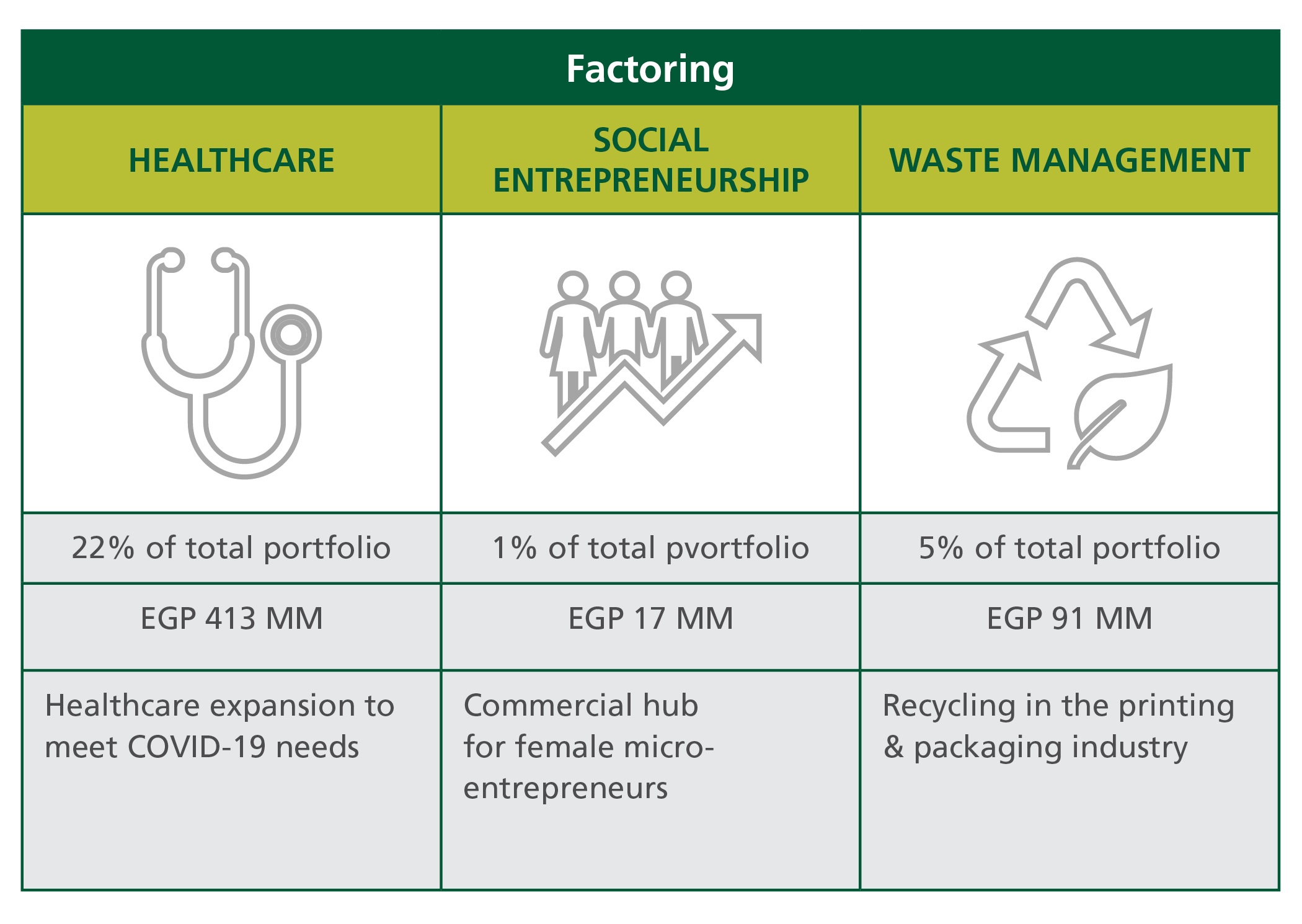

EFG Hermes is taking confident steps in helping bridge this financing gap in key sectors through Corp-Solutions, one of its flagship NBFI subsidiaries. Corp-Solutions provides leasing and factoring services that can be combined in customized packages designed to provide optimal financing. In sectors such as education and healthcare, these services can be leveraged to provide critical funds for sustainable investments. 3

TAKING THE LONG VIEW-INVESTMENT BANKING FOR A SUSTAINABLE FUTURE

EFG Hermes Investment Banking division brings deep understanding of companies, indus¬tries, markets, and economies FEMs. The team’s on-the-ground presence combined with a flexible business model quickly adapts to changing market dynamics and have allowed the Firm to offer advisory on a multitude of value-added services to an ever-growing client base. In 2021, EFG Hermes’ concluded strategic advisory services for several projects that create an enabling environment for the realization of the SDGs, both in Egypt and abroad.

Water Security and Infrastructure: Alkhorayef Water & Power Technologies

EFG Hermes KSA Investment Banking arm successfully concludes advisory on Alkhorayef Water & Power Technologies’ (AWPT) SAR 540 MM (USD 144 MM) IPO on Tadawul. The company operates in a vital sector that receives great government support to improve water and sewage services for all nationals and residents across the Kingdom. The IPO helps to enhance its competitive position and grow its market share in the Kingdom, focusing on the application of advanced technology, digital solutions and renewable energy to water and power. The water utility’s operations are concentrated in cities across the Kingdom, fulfilling the sector’s value chain needs. The utility provider operates in three key sectors, water, sewage and integrated water solutions through engineering, construction, operation and maintenance, and supply.

Financial Inclusion: valU’s First Securitized Bond Offering

In 2021, EFG Hermes Investment Banking embarked on the first-of-its-kind securitization program for a Buy-Now, Pay-Later (BNPL) fintech platform, valU, the cornerstone of the EFG Hermes NBFI platform. The transaction comes at a key juncture for the company, where value- added services that foster financial inclusion and accessibility are in high demand.

Microfinance Infrastructure: Fawry For Banking Technology And Electronic Payments

EFG Hermes successfully concludes advisory on the follow-on sale of ca. 73.9 million shares of Fawry For Banking Technology and Electronic Payments on the Egyptian Stock Exchange. Fawry has been committed to serving millions of consumers and businesses using diverse payment channels and an unrivaled infrastructure network of more than 230 thousand service points across 300 cities. Today, it stands as the nation’s leading electronic payments gateway and Egyptians’ primary e-payment platform of choice, bringing critical financial services to a large unbanked segment, particularly microfinance.